e filing 2019 deadline

Every day your tax return is delinquent the IRS typically charges interest failure to file penalties and failure to pay penalties until you file your return and pay the balance due. F Participation in the paycheck protection program--In an agreement.

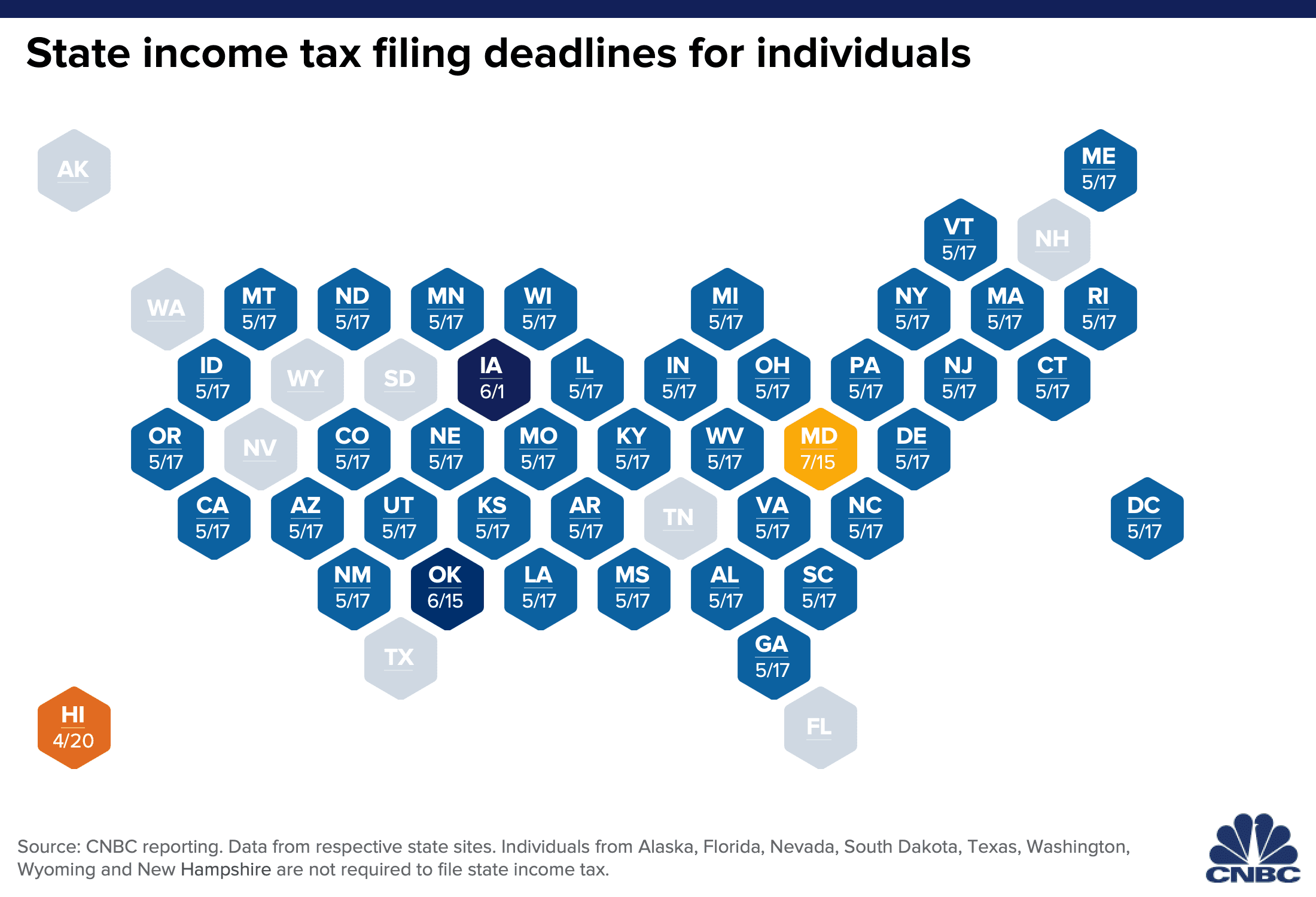

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

TDS stands for tax deduction at source while the TCS stands for tax collected at source.

. Section on holiday pay updated with further clarity on when employees can be furloughed. The 2020 edition is available in no fewer than 29 languages from Estonian and German to Pashto and Spanish. The timely tax filing and e-file deadlines for all previous tax years - 2020 2019 and beyond - have passed.

If you filed an extension by April 18 2023 2022 tax year filing deadline it extends your filing deadline to October 16 2023. As per the Income-tax Act if any person makes a payment to the receiver then TDS is required to be deducted at a prescribed rate and then deposited with. My office is pleased to provide this service to new homeowners in Palm Beach County.

E Any surety bond furnished under the provisions of this section shall be payable to the governor and his successors in office. Asteriskservice Announced Custom WebRTC Solutions. To apply under these streams you must.

Check the PENALTYucator for detailed tax penalty fees. Log in Here. If you expect to owe money youre should estimate the amount due and pay it with your Form 4868.

Material Handling Equipment Market 2019. File 2019 Tax Return. The deadline for putting it into effect is the start of the first payroll period ending 30 or more days after you turn it in.

Register an expression of interest for the streams you are interested in. Venue for a suit to recover an amount claimed by the state to be due on a surety bond is in Travis County. An extension of time to file your return does not mean an extension of time to pay your taxes.

Modernized e-Filing MeF for City taxes. Additionally consider filing a tax extension and e-file your return by the October deadline. Forget that paper tax return.

By filing Form 4868 you can add 6 months to your filing deadline. Electronic filing e-filing online tax preparation and online payment of taxes are getting more popular every year. The definition excludes fruit or vegetable juice concentrated from 100 percent fruit juice that is sold to consumers eg.

Not-for-profit Mortgage Brokers are Covered Entities. June 2020 Publication of Revision 102019 The June 2020 publication of Revision 102019 updates sections of MPEP Chapters 100-1000 1200-1500 and 1700-2800. You must submit all registrations and applications from your profile in the OINP e-Filing Portal.

The deadline to file a 2021 tax return has passed. The deadline for 2022 Homestead Exemption was MARCH 1 2022. The Walt Disney Company commonly known as Disney ˈ d ɪ z n i is an American multinational mass media and entertainment conglomerate headquartered at the Walt Disney Studios complex in Burbank CaliforniaDisney was originally founded on October 16 1923 by brothers Walt and Roy O.

Quicken and QuickBooks import not available with TurboTax installed on a Mac. IRS and state e-filing season and extension deadline - from the IRS opening date to the October date the current tax year returns are able to be electronically filed. Filing a Late Tax Return in 2022.

How to file and pay City taxes. The deadline for filing your return paying any tax due filing a claim for refund and taking other actions with the IRS is extended in two steps. E-file fees do not apply to New York state returns.

The E-File process now allows for taxpayers who have recently purchased their property to file for Homestead Exemption even if their. Interest penalties and fees. Tax forms instructions.

Receive an invitation to apply. Welcome to Homestead Exemption online filing. File 2018 Tax Return.

If you choose a program and qualify you will not be charged for preparation and e-filing of a federal tax return. The Punjab Accountants Association has requested to government extend the deadline for filing ITRs salaried non-audit for the annual year 2022-23 as per income tax section 1391 of the I-T Act 1961 as well as a request to make permanent the date of filing ITRs as 31st August in the future. Prior year 2019 earned income.

File 2017 Tax Return. It also operated under the. First your deadline is extended for 180 days after the later of.

Additional fees apply for e-filing state returns. Make an appointment for City taxes or a water bill in person. 636a is amended-- 1 in paragraph 2-- A in subparagraph A in the matter preceding clause i by striking and E and inserting E and F.

Frozen 100 percent fruit juice concentrate as well as some sugars found. The Ontario Immigrant Nominee Program OINP operates online. Bulk Material Handling Market Slowly But Steadily Gaining Momentum To Reach 5683 Bn Mark In 2026.

Head of household filing status was not a choice on the 2019 or earlier Forms W-4. Collagen And Gelatin Market Industry Analysis 2023. 3 NYCRR Part 394e provides that Mortgage Brokers which seek exemption may submit a letter application to the Mortgage Banking unit of the Department at the address set forth in section 11 of Supervisory Policy G 1 together with such information as may be prescribed by the Superintendent.

Disney as the Disney Brothers Studio. File 2016 Tax Return. Pay delinquent tax balances.

File 2015 Tax Return. If you used IRS Free File last year you will receive an email from the same company that you used welcoming you back to their official IRS Free File services. Create a profile in the OINP e-Filing Portal.

Pursuant to ORC 2329153 Local Rule 9 and the Seventh Administrative Order re. View My Prior Year Returns. When you miss a tax filing deadline and owe money to the IRS you should file your tax return as soon as possible.

Check with the ICC local representative in your country for further information. Imports from Quicken 2019 and higher and QuickBooks Desktop 2019 and higher. System maintenance occurs nightly beginning at midnight and may last up to one hour.

Enter the result here and on Worksheet 1-3 line 4. If you owe taxes you still need to pay them by April 18 2022. If youve wondered about e-filing here are the answers to frequently asked questions including why e-filing is a good idea which states let you e-file how much e-filing costs and how soon youll receive your refund.

2019 and higher and QuickBooks Desktop. Find TDS return due dates and TCS return due dates with the time period and last date for filing for AY 2023-24 FY 2022-23. Free Download Gen IT Software for e-Filing.

Global Nebulizer Accessories Market Research Report 2019-2024. The updated sections have a revision indicator of R-102019 meaning these sections have been updated to reflect USPTO patent practice and relevant case law as of October 31 2019. And B by adding at the end the following.

Guidance updated to reflect that 30 November claims deadline has now passed. Incoterms 2020 is available on ICCs new e-commerce platform ICC Knowledge 2 Go in both print and digital formats. E-Filing in civil cases when filing a Praecipe Order of Sale filer must also submit document type Online Auction Fee and pay a 220 fee effective March 1st 2019.

File 2014 Tax Return. The deadline to claim 2019 tax return refunds is. These are some reasons you may want to file an.

April 15 2023 and for 2020 tax return refunds it is April 15 2024. E Subtract d from c. A In General--Section 7a of the Small Business Act 15 USC.

Repealed by Acts 2019 86th Leg RS Ch.

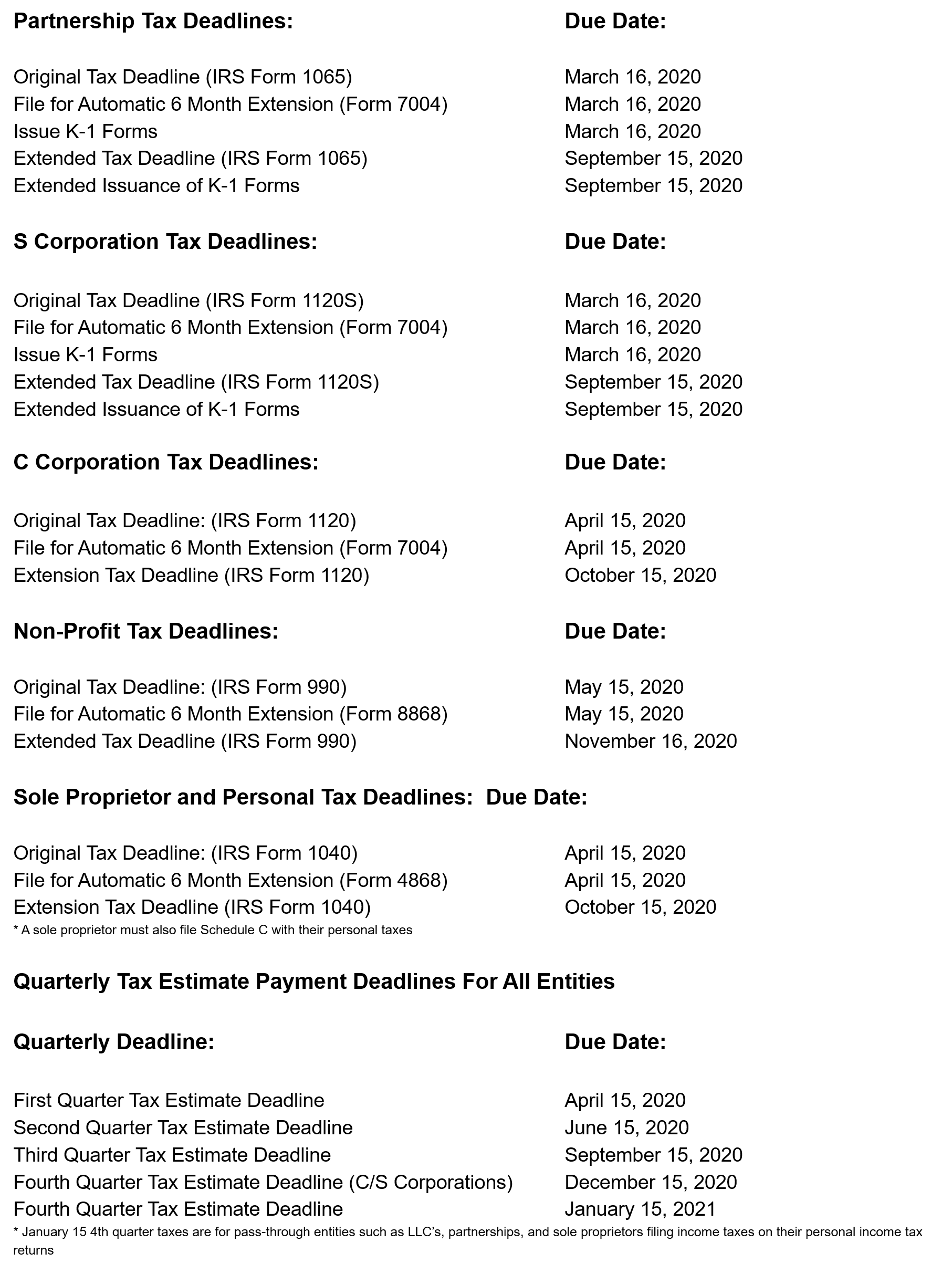

How To E File Form 7004 Business Tax Extension With Expressextension Youtube

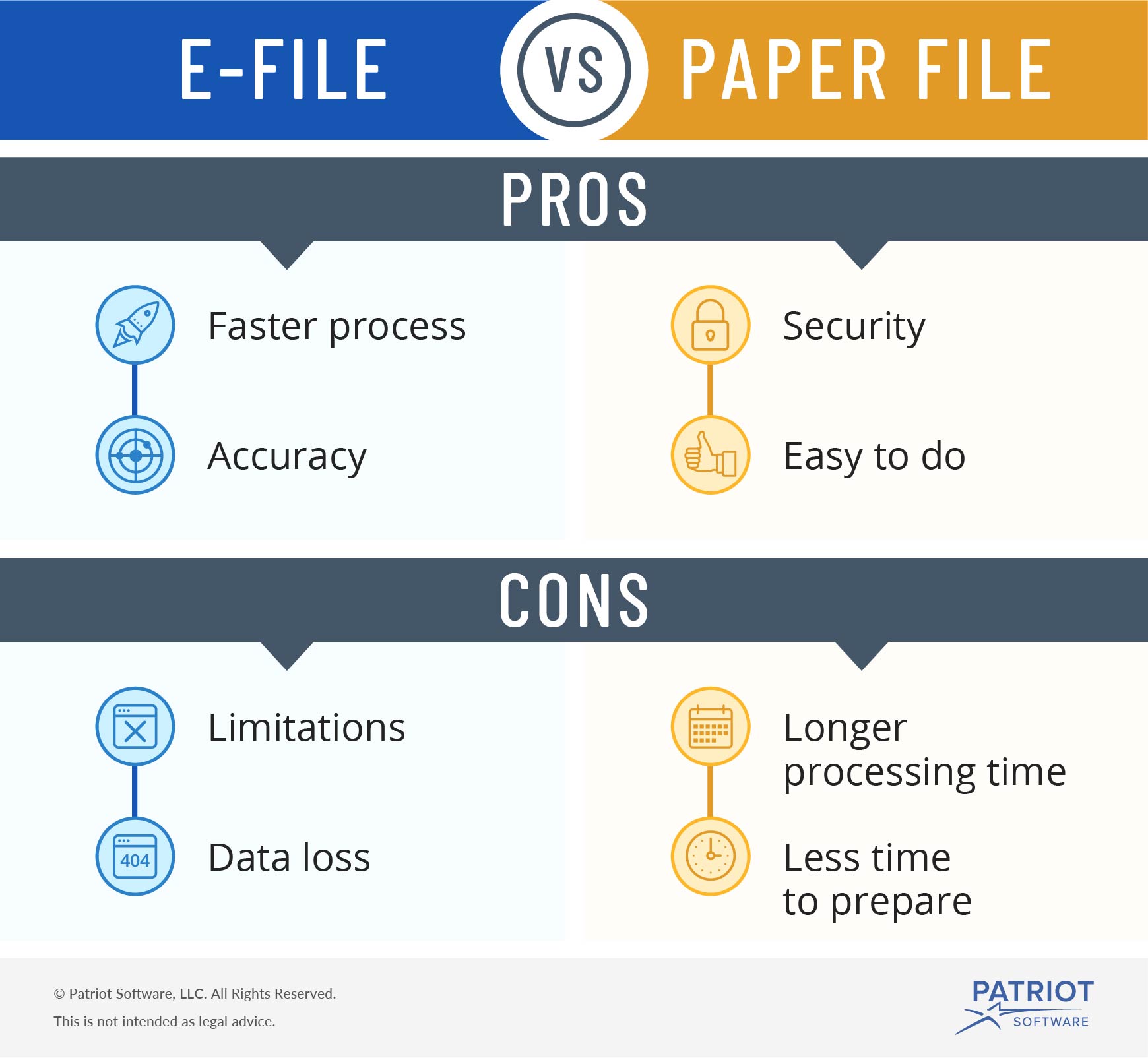

E File Vs Paper File Advantages Disadvantages

Late Filing Or Late Payment Penalties Missed Deadline 2022

When Is The Tax Filing Deadline Credit Karma

How To File 2008 Taxes In 2019 Priortax

Irs E File Rejection Grace Period H R Block

![]()

File 2019 Federal Taxes 100 Free On Freetaxusa

How To File An Extension For Taxes Form 4868 H R Block

Bear Deadline Approaching For Fy 2019 Fy 2020 Recurring Services E Rate In Pennsylvania

Irs Tax Return Forms And Schedule For Tax Year 2022

When Are Taxes Due 2022 Filing Extension Deadlines Bench Accounting

E File Deadline Archives Rapidtax Blog

Cgcc E Connects New China Annual Tax Reconciliation Atr Filing Impact To Overseas Companies And Individuals China General Chamber Of Commerce Usa

The Shutdown Will Prevent E Filing Of Individual Returns

Michigan Extends State Tax Filing Deadline Due To Coronavirus Crisis

Massachusetts Extends The Tax Filing Deadline

You Now Have Until July 15 To File Your Taxes Here S What Else You Need To Know Inc Com

Taxes Are Due Oct 15 If You Received An Extension The New York Times

Comments

Post a Comment